Worthwhile

Simple solutions quickly available at your fingertips. Apply with just one document

Simple solutions quickly available at your fingertips. Apply with just one document

Rely on our direct lending for security and innovation. Your data is protected, and we offer solutions when you need them

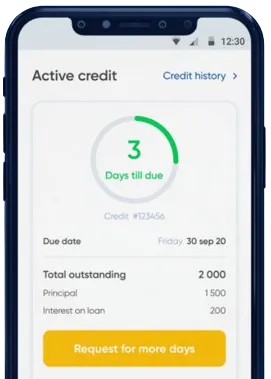

Easy, quick fixes from the comfort of your home. Instant transfer and loan extension opportunities

Fill out an application form directly in our app.

Await approval. Decisions are typically made within 15 minutes.

Get your loan deposited, typically in just one minute.

Online payday loans in Nigeria have become increasingly popular as a quick and convenient way to access funds in times of financial need. These loans are short-term, small-dollar loans that are typically repaid on the borrower's next payday. They are designed to provide a temporary solution to cash flow problems and emergency expenses.

There are several benefits to using online payday loans in Nigeria. One of the main advantages is the speed and convenience of the application process. Borrowers can apply for a loan online from the comfort of their own home and receive approval within minutes. This makes online payday loans an attractive option for those who need funds urgently.

These benefits make online payday loans a viable option for individuals who may not qualify for traditional bank loans or credit cards.

Online payday loans can be a useful financial tool for managing unexpected expenses or cash flow problems. For example, if a borrower needs to cover medical bills, car repairs, or other emergency expenses before their next payday, a payday loan can provide the necessary funds to bridge the gap.

Additionally, online payday loans can help borrowers avoid late fees, overdraft charges, and other financial penalties that may result from a lack of funds. By accessing quick cash through a payday loan, borrowers can stay on top of their financial obligations and avoid falling into a cycle of debt.

While online payday loans can be a helpful financial tool, it is important for borrowers to be aware of the risks and considerations associated with these loans. Payday loans typically carry high interest rates and fees, which can make them expensive to repay if not managed properly.

It is crucial for borrowers to carefully assess their financial situation and ability to repay the loan before taking out a payday loan. Borrowers should also explore alternative options, such as personal loans or emergency savings, before resorting to payday loans.

Online payday loans in Nigeria can be a valuable resource for individuals in need of quick cash to cover emergency expenses. While payday loans offer convenience and accessibility, borrowers should be cautious of the associated costs and risks. By using payday loans responsibly and considering alternative financial solutions, borrowers can effectively manage their financial needs and avoid falling into a cycle of debt.

Yes, you can apply for a payday loan online in Nigeria through various lending platforms that offer this service.

The requirements may vary between lenders, but common requirements include being a Nigerian resident, having a valid bank account, proof of income, and a means of identification.

The amount you can borrow with a payday loan online in Nigeria typically ranges from ₦5,000 to ₦500,000, depending on the lender and your income level.

The repayment period for a payday loan online in Nigeria is usually between 14 to 30 days, or until your next payday, whichever comes first.

Most licensed and reputable lending platforms that offer payday loans online in Nigeria follow strict security measures to protect your personal and financial information. It is important to ensure you are dealing with a legitimate lender.

If you are unable to repay your payday loan online on time, you may incur additional fees and interest charges. It is important to communicate with your lender as soon as possible to discuss repayment options. Defaulting on a payday loan can negatively impact your credit score and financial future.